Hyderabad: Starting September 22, India’s Goods and Services Tax (GST) will undergo its biggest reform since 2017. The new structure will ease the burden on households by lowering rates on essentials, healthcare, cement, and small vehicles, while shifting luxury items and harmful products into a steep 40 per cent slab.

Essentials and healthcare to cost less

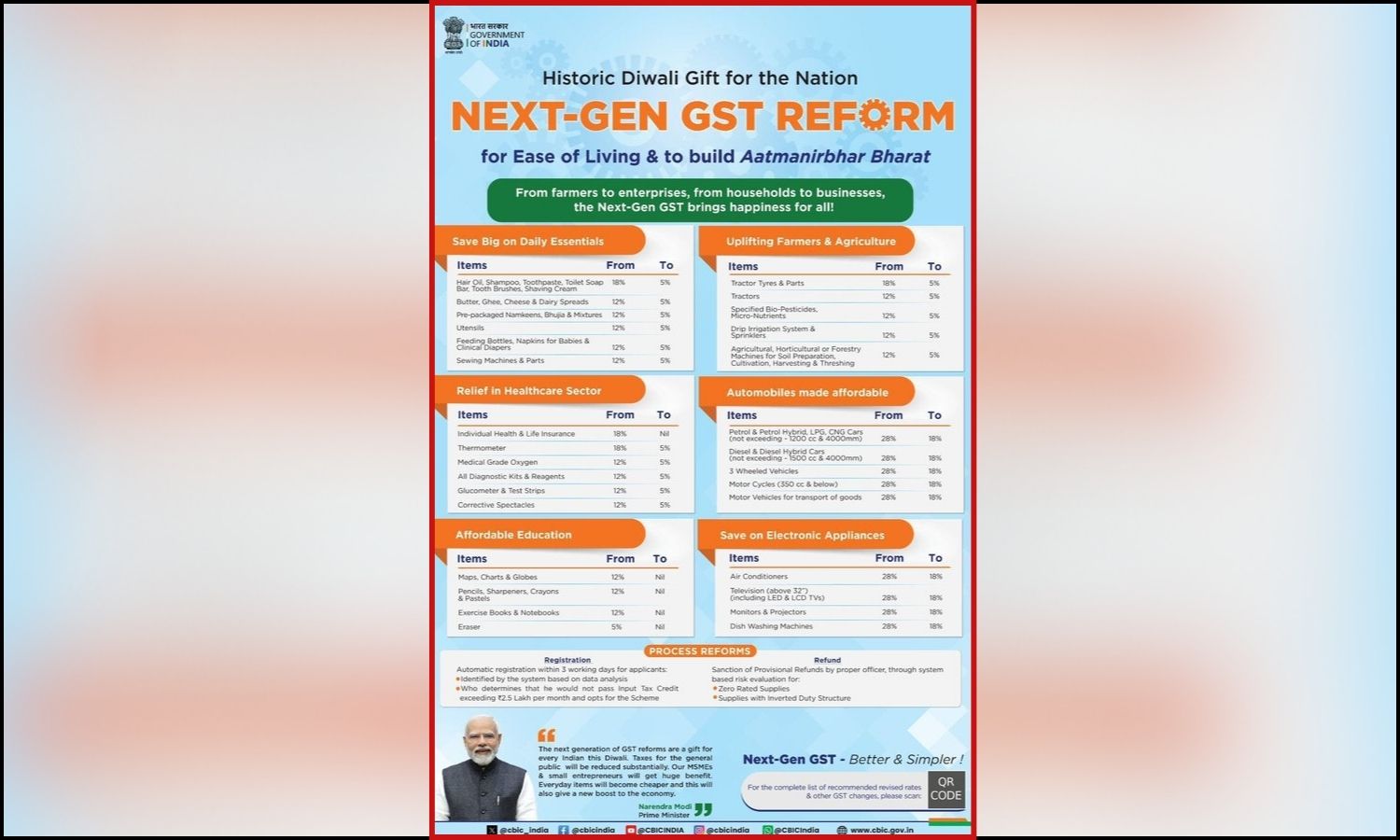

A wide range of staples will get cheaper. Chapatis, parathas, paneer, pizza bread, khakra, and ultra-high temperature milk will be exempt from tax. Butter, ghee, biscuits, fruit juices, confectionery, corn flakes, ice cream, and namkeen will now attract 5 per cent GST, down from 18 per cent.

Toiletries such as soap, shampoo, toothpaste, toothbrushes, and hair oil will also move to 5 per cent from 18 per cent. Utensils, feeding bottles, kitchenware, bicycles, and bamboo furniture will see rates cut from 12 per cent to 5 per cent. Stationery like notebooks, pencils, maps, and crayons will be tax-free.

Healthcare products will see sweeping relief: medical oxygen, thermometers, diagnostic kits, corrective spectacles, and life-saving drugs will shift to 5 per cent or nil. Premiums for life and health insurance will no longer attract GST.

Cement, small vehicles and farm machinery cheaper

Cement will now be taxed at 18 per cent instead of 28 per cent. Motorcycles below 350 cc, small hybrid cars, and auto components will also move to the 18 per cent slab. For farmers, machinery, fertiliser inputs, biopesticides, and tractor parts will now be charged only 5 per cent.

Luxury, soft drinks and tobacco to get costlier

The Council has reserved a new 40 per cent GST slab for luxury consumption and harmful products. Aerated and caffeinated drinks, including popular soft drinks, will attract the highest tax rate. Large cars and SUVs above 1,200 cc, motorcycles over 350 cc, racing cars, yachts, and personal aircraft will also move into this category.

Tobacco and related products, once the cess regime ends, will be taxed at 40 per cent. Services such as casinos, online gaming, horse racing, and even IPL tickets will face the same levy.

Centre calls it a pro-people move

Prime Minister Narendra Modi hailed the overhaul, calling it a “pro-people reform that will benefit households, farmers, MSMEs, women, and youth,” while boosting demand and simplifying compliance for businesses.